Driving change: Kia's meteoric rise and the electric vehicle takeover in Australia

29 Apr 2024

The automotive industry is facing a storm of challenges, from rising interest rates and supply chain disruptions, to soaring production costs and limited consumer options. Contenders like KIA and MG are emerging by providing affordable, high-quality vehicles. The Australian auto scene is not only witnessing a shift towards budget-friendly options, but also a surge in electric vehicle (EV) adoption due to growing environmental consciousness among consumers. In this engaging blog, we’ll delve into the dynamic landscape of the auto industry, discussing the challenges at play, shifting consumer preferences and the EV revolution.

Market Dominance: Giants vs. Challengers

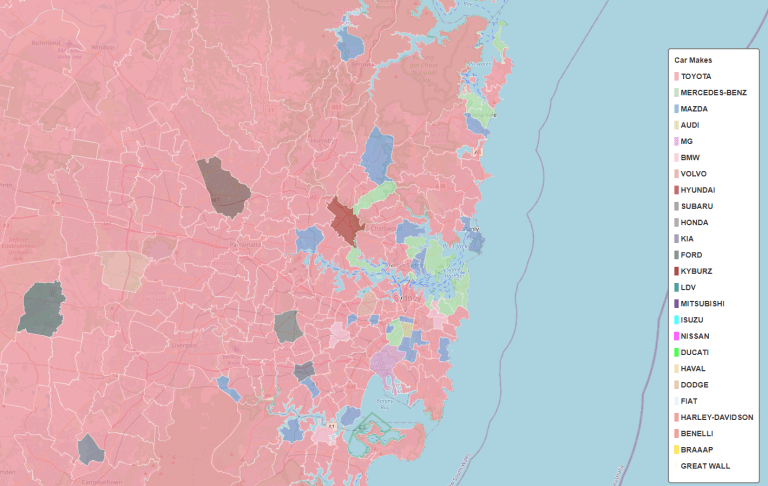

Despite the changing tides, automotive powerhouses like Toyota and Mazda still hold significant market share. Up until the start of January 2022, Toyota was the top manufacturer in 67% postal areas (1,880 out of 2,821), with Ford and Mazda close behind.

This animation provides insights into the cumulative movement of new vehicles registered in Australia, with Toyota leading the charge significantly for the most new registrations between 2002-2022. Mazda has shown accelerated growth over the decades.

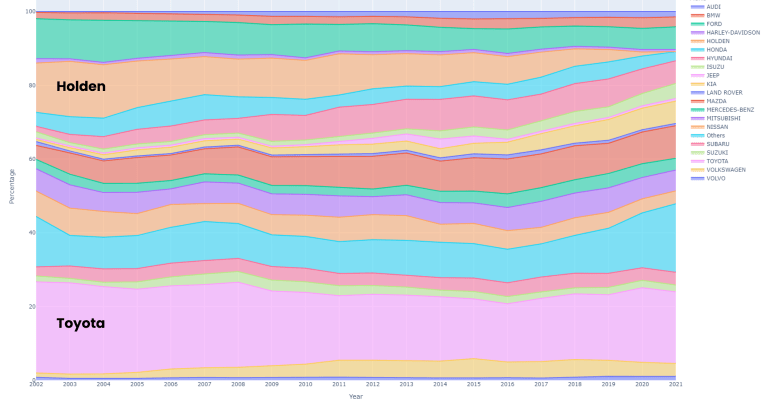

Toyota’s market share has remained stable at around 25% over the past 20 years, while Holden’s share saw a gradual declined, leading up to its production closure at the end of 2021.

The changing landscape has opened doors for new contenders like KIA, MG and ISUZU (6.27%, 3.89%, and 2.8% increase between 2002-2021, respectively) and other smaller brands, which have all increased their market shares during this period.

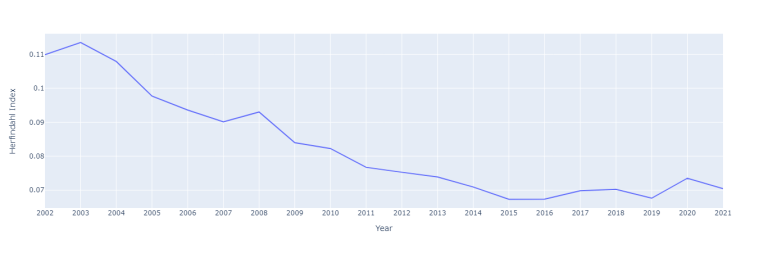

The Herfindahl–Hirschman index

Another measure that supports the inference of increasing competition is the Herfindahl–Hirschman index (HHI), a beloved metric we have used in our analysis before. It represents the diversity of car makes within each postcode, with lower values indicating increased diversity. Over the past 20 years, HHI values have decreased, pointing to a wider range of cars and reduced dominance by market giants.

However, increased diversity doesn’t necessarily guarantee a perfectly competitive market due to potential barriers to entry such as existing dominant market shares, established brand reputation, and balancing cost-efficiency with product quality.

Emerging Contenders: Driving Towards Affordability and Sustainability

The future of the auto industry lies in the perfect blend of affordability and sustainable technology. Brands like KIA and MG offer cost-effective choices to consumers, making them increasingly popular. With governments worldwide setting ambitious emissions reduction targets, it’s no surprise that EVs are gaining traction and shaping the market.

KIA and MG have made significant strides in recent years, capturing market share, thus rising in ranking with their commitment to offering high-quality, affordable vehicles. Their growth reflects the broader industry shift towards budget-friendly options as consumers navigate challenging economic conditions.

A comparison of car make rankings based on market share (%) 2002-2021

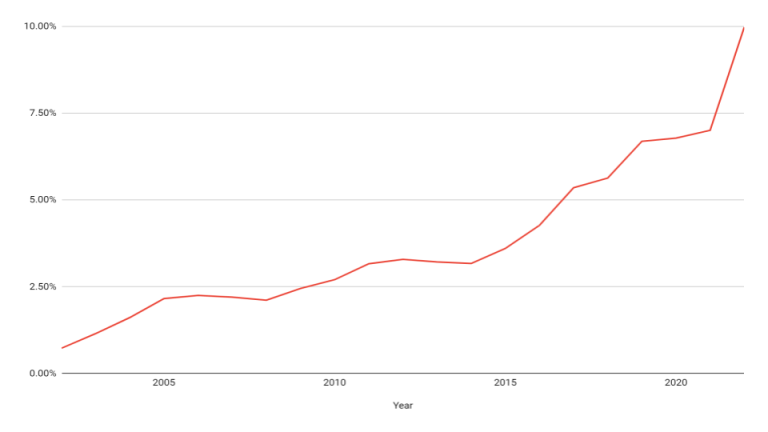

KIA: A New Leader in Quality and Affordability

KIA’s surge in popularity can be attributed to its high-quality, reliable vehicles, eye-catching design, cutting-edge technology, competitive pricing, and effective marketing campaigns. This winning combination has helped KIA cultivate a loyal customer base, as demonstrated by the steady increase in newly registered KIAs in Australia, from approximately 2,300 new registrations in 2002 to over 63,000 registrations at the end of 2021. This has resulted in a dramatic increase in market share from less than 2.5% up to 10%.

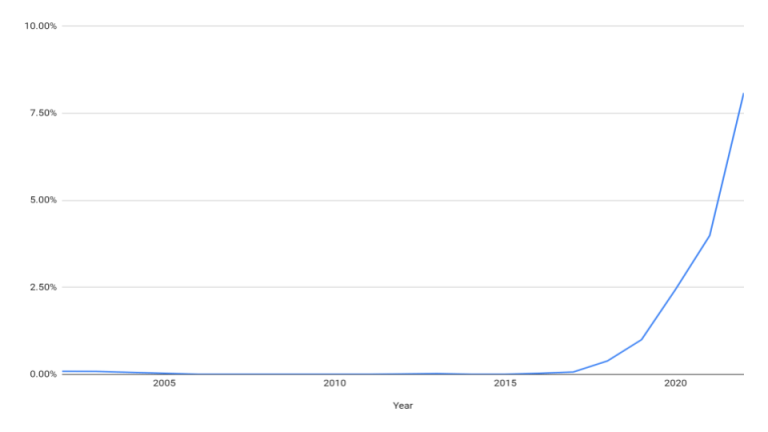

MG: Rapid Growth in the Pandemic Era

MG has experienced exponential growth during the pandemic, thanks to its similar value proposition. Like KIA, MG offers consumers an enticing blend of quality and affordability. It has grown from approximately 300 new registrations in 2002 to a dramatic growth of over 36,000 at the end of 2021.

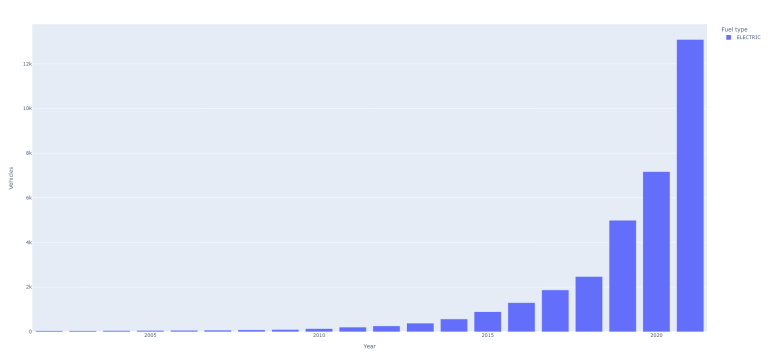

EV Adoption: Australia Charges Ahead

Australia is making impressive strides in reducing carbon emissions by promoting electric vehicle (EV) adoption. Through government incentives and technological advancements, major car manufacturers are introducing new models to the Australian market, driving momentum towards sustainable mobility.

Although still in the early stages, the market share of EVs and hybrid electric vehicles (HEVs) has seen a dramatic increase over the past two years, doubling in both categories and heralding a significant shift towards eco-friendly transportation.

The adoption of electric vehicles (EVs) in New South Wales (NSW) is experiencing nothing short of phenomenal growth.

Newly registered EVs per year (NSW)

Likewise, Victoria (VIC) is also witnessing a strikingly similar trend, with EV adoption skyrocketing in both states.

Newly registered EVs per year (VIC)

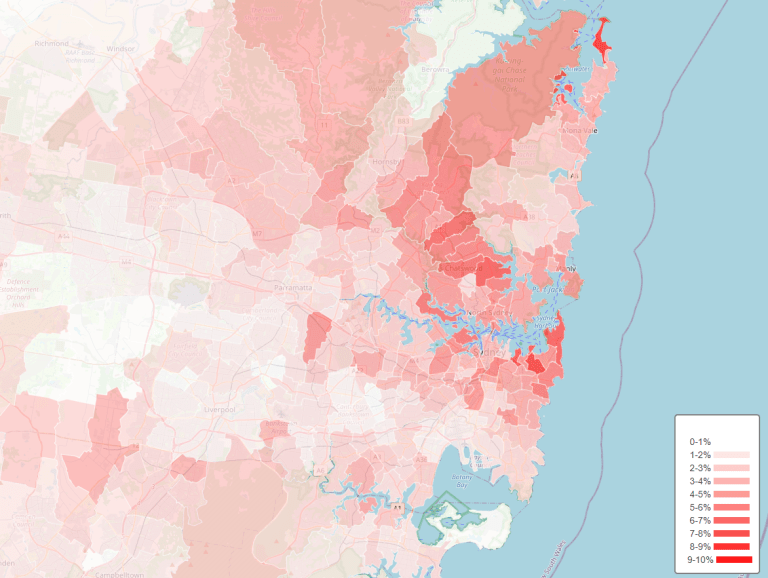

The heat map below shows that the EV market share has rocketed to an impressive 10% in some postal areas. This visualization highlights the substantial growth and bright future of the electric vehicle market.

EV market share (%) by postcode

Another notable recent development in the EV scene is the launch of KIA’s EVs in Australia which has already been met with high demand. This announcement was made in May 2023, and the EV9 became available in October 2023 (past the end of our dataset). In light of this, the future of EVs and KIA are experiencing growth and it is expected to continue. When the data becomes available, we’ll be there.

Conclusion: The Road Ahead

The Australian auto industry is undergoing a period of rapid transformation, with rising stars like KIA and MG shaking up the market by offering affordable, high-quality vehicles. Simultaneously, electric vehicle adoption is gaining momentum as Aussies embrace eco-friendly transportation solutions.

As we navigate this exciting period, we can expect to see an even greater diversity of car options, intensified competition among manufacturers, and a stronger focus on sustainability. In the years to come, the auto industry will continue to adapt and innovate in response to consumer demands and global trends.

References:

This data was sourced from the Bureau of Infrastructure and Transport Research Economics (BITRE) between 01/01/2002 – 01/01/2022.

Frequently Asked Questions

What factors contribute to the rising competition in the Australian automotive market?

The rising competition in the Australian automotive market can be attributed to several factors, including the emergence of new contenders like KIA and MG, the gradual decline of established giants like Toyota and Mazda, and an increase in market diversity as indicated by metrics such as the Herfindahl–Hirschman index (HHI). However, barriers to entry such as existing market shares and brand reputation still pose challenges to achieving a perfectly competitive market.

Why was the Herfindahl–Hirschman index (HHI) used in the analysis?

The Herfindahl–Hirschman index (HHI) was utilised as a metric to assess the diversity of car makes within each postcode, providing insights into market concentration and competition. Lower HHI values indicate increased diversity, which can be indicative of a more competitive market landscape. By analyzing HHI trends over time, it becomes possible to identify shifts in market dynamics and the level of competition among automotive brands.

What trends are shaping the future of the Australian auto industry?

The future of the Australian auto industry is characterised by a shift towards affordability, sustainability, and electric vehicle (EV) adoption. Brands are focusing on offering budget-friendly options while incorporating sustainable technology to meet consumers' evolving preferences. The increasing momentum towards EV adoption, supported by government incentives and technological advancements, is expected to drive further transformation in the industry.

About EdgeRed

EdgeRed is an Australian boutique consultancy specialising in data and analytics. We draw value and insights through data science and artificial intelligence to help companies make faster and smarter decisions.

Subscribe to our newsletter to receive the our latest data analysis and reports directly to your inbox.